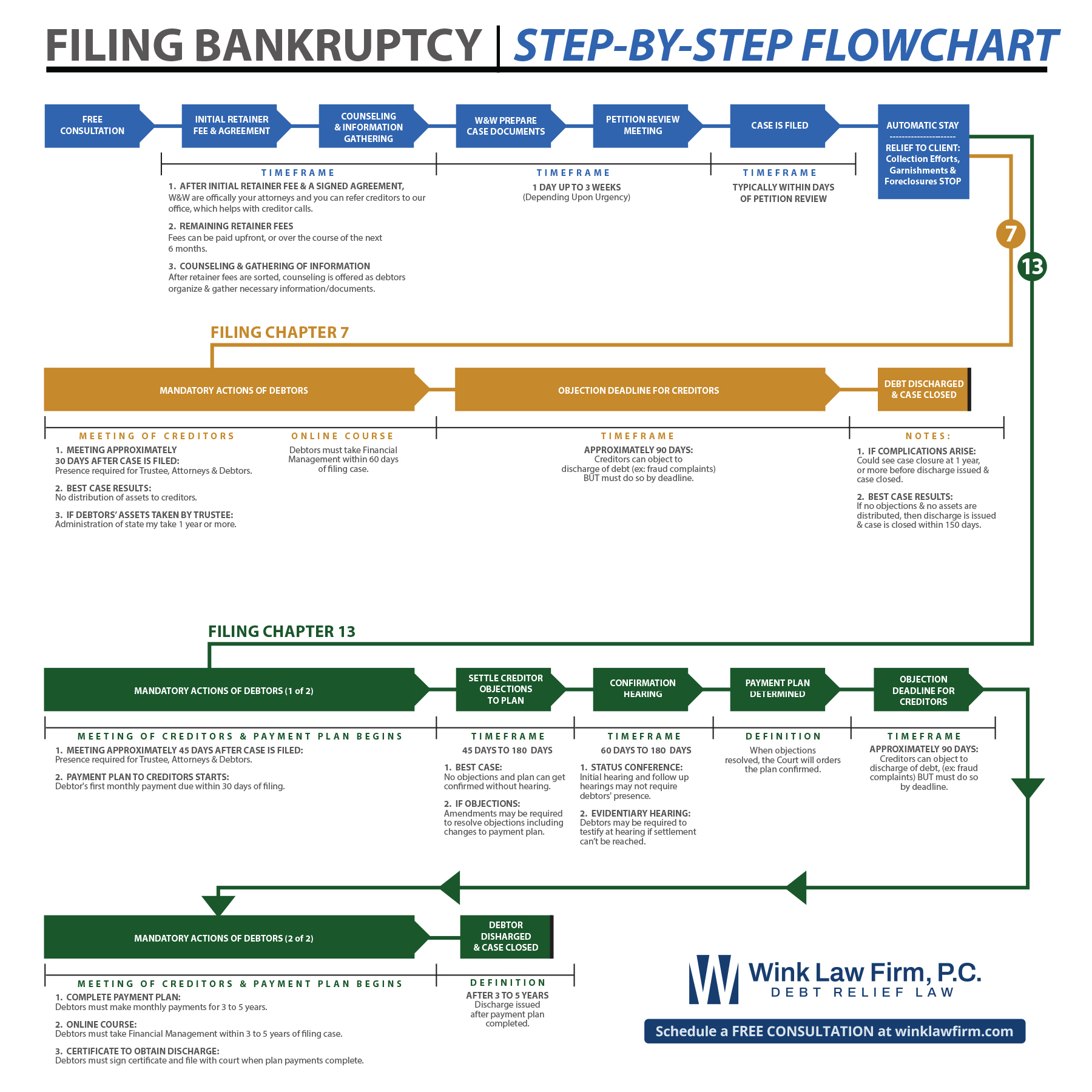

Once The Wink Law Firm is retained, you can refer creditor calls to our firm and begin work on the documents you’ll need to provide and steps you’ll need to take prior to filing bankruptcy. When you have decided to file bankruptcy, you will want to stop paying your credit cards and other unsecured debt. This typically gives people enough financial breathing room to pay the balance of our fees.

When you have paid the fees due and provided the necessary documents, The Wink Law Firm will prepare your case and then meet with you to review and sign the bankruptcy paperwork before it is filed. You will have to attend a meeting of creditors approximately 4 to 6 weeks after your bankruptcy is filed. In Chapter 7 bankruptcy, your discharge may enter and your case close within six months. In Chapter 13 bankruptcy, you will have to make plan payments for three to five years before your discharge enters and case closes.

Once you retain The Wink Law Firm, our commitment to you is to make certain that you understand the bankruptcy process and your role in that process. We will be with you every step of the way toward a fresh start. To help ensure this, we will provide you with our personal cell phone numbers so that your questions and concerns are addressed when they arise. Contact us to schedule a FREE CONSULTATION.

Requirements Prior to Filing

Prior to filing your case with the Colorado Bankruptcy Court, the law requires that you take a credit counseling course. The course typically takes an hour or two and can be done online or over the phone.

In addition to paying our fee and completing the credit counseling course, you will need to provide paperwork so The Wink Law Firm can prepare your bankruptcy documents. This paperwork includes six months of bank statements and paystubs, two years of tax returns, and statements from your creditors. You must also list and value all of your property.

Filing for Bankruptcy

After The Wink Law Firm prepares your bankruptcy documents, we’ll meet with you to review and sign them before filing your case. When your bankruptcy is filed, you are protected from your creditors pursuant to the automatic stay. The automatic stay means that creditors may no longer take any action on your personal property, including your car and home, wages and bank accounts, and must also stop any contact with you at all. No more harassing phone calls or letters! Additionally, if creditors break this rule, we can sue them for damages.

Meeting of Creditors

Once your case is filed, your meeting of creditors will be scheduled approximately four weeks out. The Wink Law Firm will advise you of the date and time for your meeting of creditors, which is now conducted through a Zoom video conference. While your creditors could attend this meeting and ask you questions, most creditors do not attend the meeting of creditors. However, the Bankruptcy Trustee will conduct the meeting and ask you questions, which you are required to answer under oath. The Wink Law Firm helps ensure that you are prepared for this meeting and we will be there to handle any issues that arise.

- Chapter 7 Bankruptcy: If you file Chapter 7 bankruptcy, creditors have 60 days from the meeting of creditors to file any objections to your case. You also have 60 days to add any missed creditors. Creditor objections are rare in Chapter 7 and discharge typically enters after the objection deadline passes. You can then begin your new start, free from the debts discharged in your case.

- Chapter 13 Bankruptcy: If you file Chapter 13 bankruptcy, you will then begin payments on your repayment plan within 30 days of your case being filed. This repayment period will last from three to five years. The Trustee and Creditors can and usually do file objections to your plan. The Wink Law Firm has a lot of experience resolving these objections. There will be a confirmation hearing scheduled in your bankruptcy to resolve objections. The Wink Law Firm will represent you at any hearing. Most debtors in Chapter 13 bankruptcy do not have to attend the confirmation hearing, as it is handled by the attorney. Once your plan is completed and you have made all required payments, you will receive a discharge. Then you can begin to enjoy a financial life free from all debts discharged in your case. If any new issues arise during your repayment plan, we are always available to assist you. We can file for a modification of your plan to address any financial changes that arise during the period of your Chapter 13 plan.

Prior to receiving your discharge in either a Chapter 7 or Chapter 13 case, you will be required to take a financial management course. This also can be taken online.

With The Wink Law Firm, P.C. as your Colorado bankruptcy lawyers, you can rest assured that your bankruptcy case will run smoothly on your way to debt relief and financial freedom. We are always here to help you, before and after your personal bankruptcy. Contact us to schedule a FREE CONSULTATION.